Of course this is a very generic question, but I understand why people ask it. I asked the same question when I first started. Let's be honest, it's a confusing world out there in investment-land. There are just so many different options and possibilities that many new investors quickly become discouraged and either decide to put off opening an account or just give up and go with something standard like an IRA or a Roth IRA. First let me emphasize that there is absolutely nothing wrong with that. Many people just want to focus on advancing their career and not worry about managing their investments. You know what though? I'll bet that a big reason for that sentiment is that many people over-complicate the process and become intimidated or discouraged because they feel like they just don't have the mindset to be able to handle it. That's you right? You're the overwhelmed, intimidated, frustrated and flustered (non)investor. Let me guess, you feel like you're going to open the wrong kind of account and be stuck with something you don't know how to use, right? You're afraid you're going to need EIGHTY-SEVEN BILLION DOLLARS by 9am tomorrow to put into your account and that the stock trading police are going to come after you if you don't buy and sell stocks every single day, buying into and selling out of mutual funds, ETFs, options, short sales, stocks, bonds, foreign currencies, and every other investment vehicle under the sun...right? Well, wrong. Don't over-complicate this. It's not hard.

First, let's talk about the different types of accounts you can open:

- Individual Brokerage Account:

- For the majority of the people reading this blog, this is going to be your choice. An individual brokerage account gives you the ability to buy and sell stocks, mutual funds, exchange traded funds and options, as well as buy on margin (borrow stocks) and sell short if you want (assuming you fill out the right paperwork and get the right approvals). Think of this type of account as a checking account for stocks. My advice is to start here and expand as you learn more. This is the type of account that I use and it covers 99% of the things I do in the market on a daily basis.

- Joint Brokerage Account:

- Same as an individual brokerage account, except it's managed by more than one person. Just like a joint checking account.

- Individual Retirement Account (IRA):

- An IRA is a long-term account. Any money you put into it can be deducted from your taxable income when you do your taxes (i.e. if you make $50,000 a year and put $4,000 of it into an IRA, you will only pay income tax on $46,000). This benefit comes at a cost though: you can't withdraw any of the money before you are 59.5 years old (with a few exceptions) unless you want to pay a 10% penalty, and when you withdraw it you will pay taxes on anything you earned.

- Roth Individual Retirement Account (Roth IRA):

- A Roth IRA is just like an IRA except for a couple key differences: when you put money into a Roth IRA you don't get the benefit of being able to deduct it from your taxable income. However, there are a couple benefits: First you can withdraw any money you've put in (principal) at any time, although you'll pay penalties if you withdraw anything you've earned. Second, when you reach age 59.5 you can withdraw all of the money TAX FREE. That means that with a Roth IRA as long as you wait until you are 59.5 to withdraw the money you've earned, you can do it without paying taxes on it.

- In most situations, a Roth IRA is a better decision than a traditional IRA over the long term, however, neither a traditional or a Roth IRA is a good choice if all you want to do is buy/sell a few stocks. IRAs are called IRAs for a reason: they are retirement accounts. IRAs are designed to be funded gradually over time to earn slow, long term gains and build your retirement nest egg. They are not designed to make extra spending cash or build profits quickly...that's what an individual brokerage account is for.

- Corporate, Proprietorship, Trust Fund, other complicated accounts:

- For beginner purposes, I'm not even going to get into these. I don't use them, don't know how to use them, and would be doing you a disservice if I tried to teach you how to use them yourself. Just know that they exist and that eventually they might be useful to you.

When your broker receives your order, they work their magic and send your order to one of the stock exchanges like the NASDAQ or NYSE to be "filled." To simplify the process, the broker manages all the orders. The stock exchange handles matching the orders with each other. Let's say you want to buy 100 shares of company XYZ at $10 per share. You place the order with your broker, your broker sends the order to the stock exchange, and the stock exchange finds a seller who is willing to sell you 100 shares of company XYZ at a price of $10. Once that match is made, your order is filled and your broker charges you a small fee (a commission) for their trouble. Before you ask, no, you can't just contact the seller directly and place the order to avoid your broker's commission. If you want to do that you'll need to be a market maker and probably have an account balance in the hundred of millions of dollars.

So what sets one broker apart from another? Simply put: fees. Realize that every time you buy shares of stock you will be charged a commission. You will also be charged that commission when you sell the stock. Therefore the price of the commission should be your very first concern, since you will pay it every time you buy and sell stock. I know that right now eTrade charges $7.99-$9.99 per trade, Ameritrade charges $9.99 and Scottrade charges $7. There are cheaper brokers, but your best option is to pick a broker that is well-known because they will have the best customer service and offer the best help for new investors.

One other thing: don't be fooled by brokers that say "Open an account and get $500!" eTrade and Ameritrade both do this, and what it really means is $500 worth of free commission within the first 60 or 90 days. They will not give you $500 in cash, so really if you're just starting and you're only going to buy one or two stocks and then hold them for 3-6 months to learn how they work, this "benefit" is only worth about $15-20 to you (the cost of one or two buy/sell commissions). It's not a bad thing if brokers offer this, Scottrade might even do it now; all I'm saying is don't let that make your decision for you because it's not really $500 for a beginning trader/investor. Focus on the cost of commission, the minimum deposit amount and whether or not the broker charges maintenance fees or inactivity fees, as well as the layout and ease of use of their website, their customer service, etc.

Personally I started with Scottrade and would recommend them for beginners for a few reasons:

- They have the cheapest commissions (and there are no decimal places which annoy me).

- They have fantastic customer service and you can call their local offices or walk in any time to ask them questions or sit down with an adviser for free.

- Their website is easy to use, clean and clutter free.

- They have a very low minimum initial deposit (as little as $500 can open an account).

- They don't charge maintenance fees or inactivity fees if you don't invest. There are no hidden fees that I know of and I have invested with Scottrade for 4 years.

- Their investor education resources are great and they simplify many things that other brokers complicate (for example, they provide help for selecting an order type right on the order page). These are the types of things that are very useful for a beginning investor and encourage investment rather than complicating it and discouraging you.

1. Click "Open a New Account:"

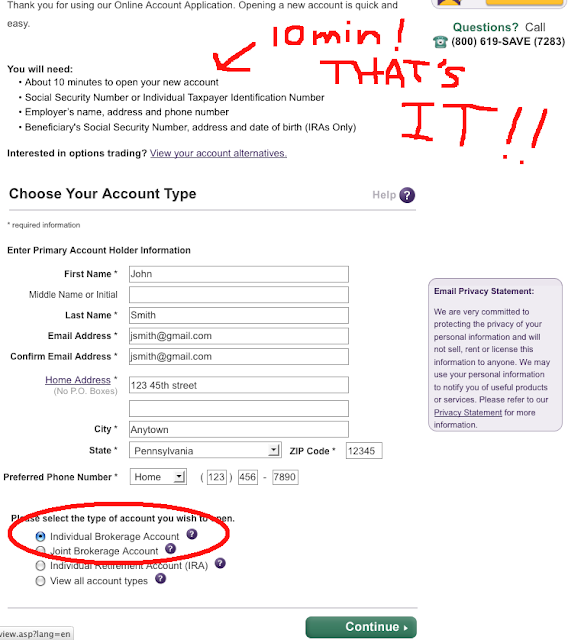

2. Fill out some basic info about yourself and select individual brokerage account:

3. Pick a branch near you in case you need to go there. This is also where they'll mail your check from when you make a bazillion dollars, so the closer the better!

4. Fill out your employment info and answer no to the three questions. The questions here are trying to make sure you're not a professional (which requires a different type of account):

5. Enter your DOB/SSN and verify your citizenship. Don't lie or the police will come and steal your last pair of clean socks:

6. Verify all the information you've entered and click "Accept and Continue:"

7. Answer a few more basic questions about any extra services you want (most likely none), read/sign any "agreements," create a password, and you're done!

That's it. It's really that easy. I would go through the rest of the process but unfortunately John Smith from Anytown, PA doesn't exist and I am down to my last pair of clean socks.

Finally, once you have the account opened, you'll receive a welcome package in the mail with a bunch of info to get you started, but you can also get started right away. Scottrade is fantastic with helping new investors and guiding you through your first steps, but to give you a general idea, once you have an account you'll need to fund it. This can be done with a check by mailing it or taking it to a local office, but I recommend simply linking your bank account to it. Just like if you wanted to set up automatic payments on a credit card, you'll need your routing number, bank account number, and information about yourself, and they'll likely need to do the whole "deposit two small amounts into your bank account to confirm it's yours" deal. Once you've done that you can transfer money into the brokerage account with an EFT (for free with Scottrade!) and it will be available to buy/sell stocks. I don't remember for sure, but I believe that there is a clearing period for your initial deposit so you might need to wait 2-3 days before you can actually use the money in your Scottrade account to buy stocks.

When you log into your account you'll see all the stuff you can do. For obvious reasons I've deleted my personal information, but this should give you an idea of what you'll see. On the home tab you can see your total account value, a chart of your performance, any open orders you have pending, orders that have executed, as well as any open positions (stocks you own) and a watch list (stocks you're watching). You can create watch lists or export data to Excel for your own use, and all of these areas can be customized to show whatever info you want as you start to learn more and learn what's important to you. Also on the home tab you can find links to fund your account, get tax info, etc:

On the "Trade" tab you can place orders by selecting an order type, how many shares you want, the stock symbol (aka ticker), and how long you want the order to remain active (you can select to have it end at the end of the day, "GTC" (good 'til cancelled), end in a few hours, or whatever you want). By the way, it should be noted that you are not charged a commission until your order is actually executed, so you can place an order and cancel it as many times as you want without being charged a dime. Note the links on the right that help you select an order type. This is why I love Scottrade for newbies!!!

So that's it! Hopefully after reading this you have a solid understanding of what it takes to open an investment account and buy your first shares of stock. My recommendation as far as what to buy is to invest initially in something you completely understand. Don't invest your whole account value. Leave yourself a little bit of leeway (even if it's only like $20) in case your order doesn't get filled at the price you expect (which does happen). Do NOT assume that you will make money on it. More than likely you will either lose money or you will stay flat. I always tell people who are just starting out to look at your first investment as the cost of learning how the market works, and to assume that you will lose it all (even though you probably won't). I will also say regarding your first purchase, however, to make it significant. Make it large enough that it would piss you off if you lost it, but small enough that it wouldn't break you either. You actually want to be a little emotional at first, so that you will look at your account and be like "WHAT THE HELL!!??!" when it drops and "WOOOHOOO!!!" when it rises. Without this initial spike of emotions you will never be motivated to learn what caused the fluctuation, which is absolutely the most important thing to understand. If you get emotional on your first trade, it will motivate you to learn, and the motivation to learn is what will get you hooked. I recommend a first investment of $500-$1000 in one or two companies at most.

The first shares of stock I ever bought were shares of a company I worked for at the time. I knew everything about the company and how they operated. I knew what the company did, I knew people who worked there and understood the management style. I also had a general idea of how well the company was doing. Following this strategy for your first investment will be immensely valuable because you can buy the stock, watch it, and see how it acts. Plan to hold your first investment for at least a couple months, hopefully longer, in order to get a true understanding of how it fluctuates and moves.

Observe as you hold the stock how it reacts to changes in the market. Watch what happens when there is something in the news about the company or what happens when they release their earnings report (this happens every three months). Study the chart and try to pick up patterns by looking back a few years. On many stocks you can even pick out patterns in charts that show price in one-minute intervals! The most important thing to remember is don't get discouraged. Don't let your emotions take over and sell the stock just because it drops a few pennies! It will fluctuate and your account value will drop, maybe significantly. If it does, try to understand why, but keep in the back of your mind that the likelihood of you actually losing your entire investment, while possible, is very slim. It takes a lot to make a stock drop to zero, usually something huge like the company filing for bankruptcy protection or one of the insiders getting caught embezzling money or something. The point is: buy the stock because you understand it and with the intention of using it to learn the market. Don't necessarily worry about making money for your first trade. As you watch the stock and its behavior over a period of a few months, you will start to see patterns and you'll begin to see what the market perceives as "fair value" for the stock. From there you can start to see how to make money by buying it below what you think fair value is, and selling it above fair value.

Of course there's a LOT more to analyzing stocks, but that's what the rest of this blog is for. The point of this post is just to get your feet wet and get you invested. Trust me, the first time you throw $500 or $1000 of your hard earned money at a stock you will become married to it. Every tick, every penny, every day you will want to know why it changed because you will be making and losing money without actually doing anything. It was these changes that got me hooked on investing, and I bet it will get you hooked too!

No comments:

Post a Comment