Hello inter-friends!

So one of the things I have

been having a little bit of trouble with in my daily trading is having

the confidence to actually pull the trigger and execute my plan. When I

first started daytrading seriously, I overtraded a lot the very first

week and I lost a pretty large chunk of change. It was enough to make me

sit back and ask myself whether this daytrading stuff was really for

me. After that happened I took almost an entire week off to

just watch the markets and watch the trades that others were executing,

the idea being to give myself some perspective and to affirm that I did

in fact know what I was doing, I just needed to settle down and focus.

Since that time I have been much more cautious about the setups I play

and whether they are strong setups or not, but lately I've actually been

a little

too cautious. Specifically, I've fallen into a problem called

paralysis by analysis,

which basically means that I over-analyze all of my setups and

constantly wait for more and more confirmation that they are working

correctly and by the time I am confident enough to enter, it's too late.

This is a dangerous problem to have because what ends up happening is

that by the time you've finally confirmed your setup is working, if you

enter the trade there's a good chance that your risk is much,

much higher now and that the trade will turn around on you.

Now,

I make it a habit to send an email once a week to the person who is in

charge of the team of traders I work with. In the email I'll include a

list of charts that I'm watching for the week and I'll ask for his input

on the charts. Does he think the setups are strong, am I missing

anything that could make my risk higher, are they high-probability

setups, has he played these stocks in the past and had notable results?

These are the questions I'm asking and the feedback I'm looking for. I

almost always get a response back saying the charts look great, but

lately what I've found is that even though I have confirmation from

someone who's been doing this for 10-15 years, I still find myself

hesitating a bit too long and missing a lot of opportunities. To combat

this, I decided to be systematic about it and analyze all of the charts

I've sent for the last two weeks for a before and after status. That's

what this post is about.

Each of these charts are

stocks that I have been watching for the past couple weeks. The vertical

line on the "after" chart for each stock indicates the day that I made the call, so I can see

how accurate the call was by following what the stock did the day after the vertical

line. I am hoping that by going back and reviewing these charts, I will

find either a) that a high percentage of my calls were correct and that I

should just be more confident and trust my gut, or b) that many of the

setups are failing and I should reevaluate what I look for when I seek

out stocks to trade. To make it persuasive, I will also include the

amount of money I missed out on making by not taking some of these

setups, based on a $5,000 position which is usually about the size that I

play. At the end, I'll total it all up and hopefully smack myself in

the face with the realization that if I had just been a little more

confident, I could have made a

lot more than I have over the past

couple weeks. I haven't even done this myself yet, other than to take

the screenshots of the charts, so I don't know at this point what the

results will be, but let's find out:

The following are charts I started watching the week of 3/23/12. The comments on the "before" charts are questions I was asking the person I sent the charts to (click to enlarge):

ACOR before:

ACOR after:

Conclusion: This stock hasn't really done anything. I am still watching for a break of the $27.50-$27.75 area. $0 opportunity missed.

AMRN before:

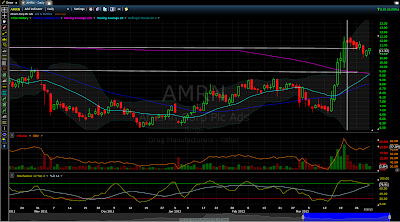

AMRN after:

Conclusion: This was a short call, meaning I thought the stock would go down. The next day it did. Assuming a drop from $11.92 to $11.60 this would have been a 2.7% gain. $137.93 opportunity missed.

BRP before:

BRP after:

Conclusion: This trade never developed. It gapped down the following day so the potential break of the flag never happened. $0 opportunity missed.

CKEC before:

CKEC after:

Conclusion: I should have taken this trade the next day. It was another short call that dropped from $12.52 to $12.20, a 2.6% gain. $131.15 opportunity missed.

CVO before:

CVO after:

Conclusion: This trade was another which gapped down and never developed. Looking at my question on the "before" chart, however, there's something interesting to learn here: increasing volume on a downtrend is a really bad sign. This actually should have been a short call in which case, had I played it the next day I would have taken a $4.02 to $3.11 gain, 29.2%, or $1463.02. This was an incorrect call but also a huge missed opportunity.

GMAN before:

GMAN after:

Conclusion: I absolutely should have traded this. The gap up the day after I called it was actually due to earnings, so it would have been lucky had I bought it the day before at $15.50 where my call was, however, I definitely should have bought at the first opportunity on the following day. I remember watching this and thinking "it can't possibly go any higher" over and over again, just watching opportunities pass me by. Had I taken the trade like I planned, I could have taken $17.15 to $19.69, or a 14.8% gain. $740.52 missed opportunity. Furthermore, this could have easily netted me over $1,000 since I would almost certainly have held part of the position for one or two more days after such a large gain on the first day. It was a huge mistake to not play this trade.

HCKT before:

HCKT after:

Conclusion: This is another one that I definitely should have played. Following the day I made the call the stock broke out of the formation just like I expected and ran from $4.80 to $5.25, a 9.4% gain. $470.00 missed opportunity.

MATR before:

MATR after:

Conclusion: This play was a potential short. However, generally speaking when a potential short goes sideways it gives it the potential to run higher. That is exactly what happened in this situation, so while the original call never developed, I should have kept this on my watch list a little more closely since when it broke the flag at $8.15 it ran to $8.75, which would have yielded a 7.36% gain. $368.10 missed opportunity.

MYRG before:

MYRG after:

Conclusion: This setup did not develop like I expected it to. However, it should be noted that the stock is now "basing" meaning it has hit the bottom and is going sideways. Usually this means that it is about to make a small correction, in this case the breakout would be above the blue line (the 50 day moving average, which I'll talk about in other posts eventually), and could be a potential run from $18.30 to $19.00, or a 3.83% gain. I am keeping this one on my watch list.

PATH before:

PATH after:

Conclusion: PATH was supposed to be a swing play, meaning I would buy it and hold it for multiple days rather than what I usually do which is buy and sell the same day. At the time I called this stock I was still waiting for a proper entry (some indication that it was turning around). That never happened, but now we see another opportunity in it, possibly above $3.85 for a run to $5.00. This is a huge gain, 29.87%, for only 15 to 20 cents risk, or $1493.51 on a $5,000 trade. I am keeping this one on my watch list for that opportunity.

PWAV before:

PWAV after:

Conclusion: I should have taken this trade. It worked just like I'd planned, opening low, taking out the previous day's high at $2.35 and then running to $2.58. This would have been a 9.79% gain. $489.36 missed opportunity.

SCVL before:

SCVL after:

Conclusion: This play was similar to GMAN, in that it had a nice setup and then an earnings release the next day. Many times I do this: scan for earnings releases and then filter those releases to charts that have strong setups, that way I have a great setup as well as an emotional catalyst to push the price of the stock. I realize now that I should have played this, even after the price gapped up as you see on the chart, because like GMAN it was a huge gainer. It did exactly what I expected it to but I thought it couldn't go any higher because it had already gapped so high. Seeing both GMAN and SCVL do this as well as many other trades that have taken place in our chat room over the last couple weeks, I am starting to learn that this is pretty standard. A large gap on an earnings release is common if the release is good, and they can sometimes run 20, 30 or even 50 percent in one day. This would have been a run from $29.19 to $32.24, or 10.45%. $522.44 missed opportunity.

I have several more of these charts including some that I started watching on 3/27/12, but after reviewing these and seeing the results I think I know what my conclusions are, and they are what I suspected: I need to trust my gut. Had I played each of these stocks as I had planned, I would have finished the last two weeks with a profit of $4322.52. Furthermore, since I made some other trades last week that netted me some $200-300 gains, and since I generally cap my losses around $130, even if I made 20 trades during the week all of these trades took place in and 50% of them failed, I

still would have netted over $3,000 in profit during that week alone! This also doesn't even count all the trades that the rest of my team makes which occasionally I take as well.

This is why paralysis of analysis is such a dangerous problem to have. Not only does it prevent you from making huge profits if you're good at what you do, but it can end up costing you money when you try to enter setups too late. For next week and going forward, I am going to use this shocking number, over $4,300 in missed profits, to convince myself that I need to follow my instincts and take the trades I have studied hard to understand. As I work through this problem I expect to see some of these profits materialize in my account, which I hope will continue to build my confidence so I can continue to improve. If you are trading and having trouble, or you constantly find yourself looking back and saying "Man, I was so right! If only..." then try backtesting your intuition like I've done here. Chances are that you know what you're doing, and you will get results similar to mine that will help motivate you to trust your gut.