Hello ladies and gents!

I wanted to do a post on how to properly prepare for a day of high frequency trading (i.e. daytrading) for anyone out there who is interested in getting involved with it. You know, it's funny: a lot of people hear the word "daytrader" and instantly associate it with lots of money made at the expense of others by a lazy person who just sits in front of their computer all day pushing buttons. In reality it's actually quite the opposite. First of all, there are very few billionaire daytraders, and most successful traders make less than $250,000 per year. While this is certainly a comfortable income, it is a drop in the bucket compared to what serious investment bankers and fund managers are making. But then, most daytraders are daytraders because they love the job, not because they want to be billionaires. Secondly, trading full time can actually be (and usually is) a 50-60 hour per week job, and that's not even counting weekends. Contrary to what most people believe, professional daytraders are not working 9:30-4pm when the market is open and partying the rest of the time. Most are up at 6am reading the news, gathering ideas, determining the general market sentiment and preparing for the market open at 9:30am. After 4pm, most are documenting their trades, analyzing their performance, and beginning preparation for the next day, many times until 6 or 7pm at night.

Trading is a full time profession and the market never sleeps, so if you are serious about doing this for a living you need to be completely immersed in it, and you need to enjoy it. I know several professional traders and almost all of them work 10-12 hour days regularly. After hours they are making watch lists, writing blog posts, reading Twitter feeds from other traders, analyzing the market action for the day, etc. The tradeoff is that if you're good at it and you do your homework, you can write your own paycheck and built a portfolio that will allow you to take off time whenever you want while letting your investments work for you. Many of the professional traders I know are completely dynamic, meaning they have trading platforms set up in their homes, on their phones, and anywhere they frequent. By doing this they allow themselves the freedom to work wherever they happen to be if they want to visit with family and friends, take vacations, etc. That is the beauty of being a professional trader. It really isn't the money - it's the freedom.

Even though I'm still far from the point of going full time as a trader, I have developed a fairly successful system for preparing for the day which I think will stick with me for a long time. I've constructed it based on my experiences with other professional day and swing traders and combined the things that they have told me work best for them with some of my own ideas. The good news is you don't need

any money to do this, so if daytrading for a living is something you're interested in you can do all this stuff without even making any trades, just to see how you might do. Anyway, without further ado here is my technique:

First of all, I am constantly reading the news. I scan Yahoo! Finance, Google Finance and Marketwatch as a time killer. When I have nothing to do at night, I will quickly jump to these sites and see if there are any major headlines. This is one of the

easiest ways to pick up ideas. Unfortunately if it's a headline, there's a good chance that by the time you get into the trade it will be too late because the price will have been driven up by those who read the news before you, but for the amount of effort it takes this technique is worth it because you might get lucky and find something great. Yahoo! Finance also has a fantastic resource called

InPlay which summarizes headlines from many different sources in a concise and easy to read format. They even go as far as to

bold sentences that they believe are important so it's easy to quickly scan through the headlines and find earnings releases, lawsuit settlements, major contracts, new customer announcements, etc. Regardless of the source, when I scan these headlines I am really only looking for one thing:

something that affects a company's bottom line. The idea of the money that might flow in from a big contract or a lawsuit settlement; the idea of the money that might be lost because a company's product needed to be recalled; an earnings release that beat estimates (or missed them): these things are extremely powerful emotional catalysts to the price of a stock and can make you

serious money when coupled with a technical setup on the chart. I scan InPlay every morning, as well as

Story Stocks. Many of my best plays have come from InPlay so I highly recommend it.

In these initial steps I am adding pretty much everything I come across to my watch list (list of stocks to watch). Anything with any shred of hope for a pop or a drop in the price goes on the list, even if it's far-fetched, because I will narrow this list down quickly later on with a really awesome and free tool. Next, I check the blog run by the guy who leads my team of traders, www.bullsonwallstreet.com. Every night the blog is updated with the watch list for the next day, created by the guy who runs the site who is a professional daytrader with over 15 years of experience. Anything that is on his list is added to mine, to be narrowed down later on. Unfortunately this service is not free, but you can also follow some of the traders I trade with on Twitter and snag pieces of this info for free in real time. That brings me to my next point: Twitter.

It might sound ridiculous, but some of the best traders I know constantly follow each other around on Twitter. There are several feeds I follow on Twitter that I'll list here so if you're on it you can follow them too and watch them trade as well as snag their watch lists which are usually posted:

- @stt2318 - This guy posts his watch lists as well as his portfolio on a weekly basis. You can see every single trade he makes, his profits and losses, his monthly performance, etc.

- @bullsonwallst - The group I trade with. This feed is mostly blog updates, but every once in a while you'll snag something useful that you can access without being a member.

- @mb_willoughby: Maribeth Willoughby - one of our team members at Bulls on Wall Street. This girl makes some amazing calls and posts a lot of them as well as her watch lists on Twitter for free.

- @BioRunUp: This guy is a professional daytrader who specializes in biotech stocks.

- @tradermarket247: Another professional daytrader who constantly makes amazing calls.

- @szaman: And another, Szeman is a great trader that I work with every day. I follow him and bman religiously and they find some great picks.

- @idrinkchai: Our resident tea drinker. This guy is a fantastic technical analyst and posts tons of his picks and his watchlists on Twitter. He is also part of the Bulls crew but no one seems to know his real name...we all just call him Chai.

- @danielmardorf: Formerly known as @johnwelshtrades, this guy is a self-made millionaire thanks to daytrading. He posts full disclosure with his trades as well as his portfolio value on a regular basis. I should mention he's effing hilarious too. Watching his feed is very entertaining because he loves to call people out when they go against his recommendations and lose money because of it.

- @kunal00: Kunal Desai - the guy who founded Bulls on Wall Street. He is a pro daytrader with over 15 years of experience and has taught me almost everything I know about technical analysis. He only posts his watch list on Twitter occasionally (since he usually posts it on the website for his paying members) but he does post updates of trades he's making all day long.

Once I have browsed through Twitter and the news, I'll usually have about 50 stocks to sort through. These stocks come from both reading the headlines and from the watchlists of other traders who have posted them on Twitter. At this point I resort to an amazing tool called

Finviz that helps me break them down. I will go to Finviz and enter all the tickers at once in the top right corner, then set the view on

charts. This makes it easy to quickly scan through the charts of the 50 or so stocks I have and narrow down the list based on patterns I like. Currently I only play a couple of different types of patterns because I am still fairly new to the daytrading game, so I will visually scan looking for those specific patterns and eliminate anything else. I will cover pattern analysis in another post, but once I scan through all the charts I can usually eliminate about 80% of them because I either don't like the pattern or the pattern is not quite ready to break yet. I also love to use some of the pre-made screens on Finviz, specifically the

unusual volume screen since it almost always has tons of stocks that have recently gone crazy and might continue to go crazy,

and stocks that are about to go crazy. There are many other useful screens built into Finviz including scans for stocks that have been upgraded/downgraded, are releasing earnings, are overbought or oversold, and countless others. You can even scan for specific chart patterns and then narrow them down based on whatever criteria you prefer.

I'm sure at this point you're starting to see a pattern. Essentially all I am doing is browsing through hundreds and hundreds of charts, reading the news, checking live feeds from other traders, and picking out anything that works for my particular style of trading. There are a number of other tools I use: Zack's

screener, Stockcharts.com's

predefined scans, Yahoo!'s

Earnings Calendar,

Stoxline, and

TickerSpy are all great resources for ideas. I also have a list of about 200 stocks that are constantly played by the Bulls crew, so I bookmarked Finviz with all those stocks entered in so all I have to do is go to that bookmark and scroll through the charts looking for anything that might be interesting. Ultimately, I usually only use these other resources for gathering possibilities, then I break them down with Finviz by visually scrolling through all the charts. It sounds like a lot of work but it's not that bad. I can usually complete this whole process in just a couple hours since I know the patterns. Once you know the patterns to look for, you can do the same!

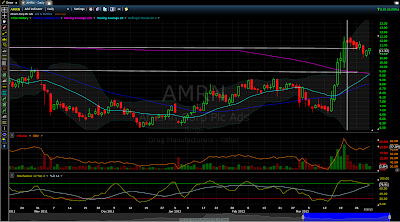

Finally, once I've got my list narrowed down to about 20-30 stocks that have patterns I like and are priced in my range, I will go through the list and analyze the charts in detail on a site like

www.freestockcharts.com. This is a great site because it allows you to annotate the charts and view them on multiple time frames all the way down to one minute, as well as add notes and set alerts. I will use this site or my trading platform itself (DAS Trader Pro) to really zoom in on the charts I like and figure out which ones might be ready to go the next day and which ones probably won't be ready for a few more days. As I go through all these stocks, I will annotate the charts by drawing support and resistance lines, trend lines, etc and make

notes right down to the very last detail about where I will enter the

trade, where my stop loss should be, what my first and 2nd targets are,

and any potential pitfalls. I also eliminate some stocks, because sometimes once I zoom in I will find that the pattern isn't as nice or that the risk is too high. What I end up with are two lists of stocks: one list of stocks that might go within the next few days, and another list that could go immediately. The list of stocks that could go immediately (usually by now narrowed down to only 6 or 7) becomes my watch list for the day. The rest of them become the first stocks I look at for the rest of the week, and as they get ready, I will add them to my daily watch list and play them, then remove them and add new ones. I create this weekly list each Sunday, and add/remove things to/from the daily watch list from it and from InPlay and my daily sources all week long.

Now that I've done my homework, I can simply wake up in the morning, scan the news for any major changes, get an idea of what the general market sentiment is, and execute on my plan. Since I've planned everything beforehand, it makes life easy during the day. All I need to do is trade.

Preparation is vital to your success as a trader. If you're a longer term investor, you don't need to prepare daily, but you should be doing an equal amount of analysis on the fundamentals of the company before you invest, so the principal is the same. As a trader, you need to do your homework because

the market doesn't wait for slackers. Even as prepared as I am most of the time, there are still times when I miss trades that could have been hugely profitable because I simply wasn't fast enough to get in when the risk was still tolerable. Unfortunately this happens, but the fast pace of the job is part of the excitement too! In the end, I really think the people who are successful in this game are the people who love to do it and so the "homework" comes naturally to them. It's up to you to decide whether or not you're one of those people.

I hope this post helps you to understand a little bit more about what it takes to properly prepare for a day of trading. Please leave comments and questions below!